ASHBURN International, part of Penki Kontinentai Group, participated in the International Forum “Digital Uzbekistan”. More than 2000 attendees from 35 countries joined the event in Tashkent. 130 speakers addressed the audience. The experts shared their experience in digitalization in various areas of the financial sector. Although cash continues to play a significant role in Uzbekistan’s economy, there is a general trend towards a gradual transition to cashless payment methods.

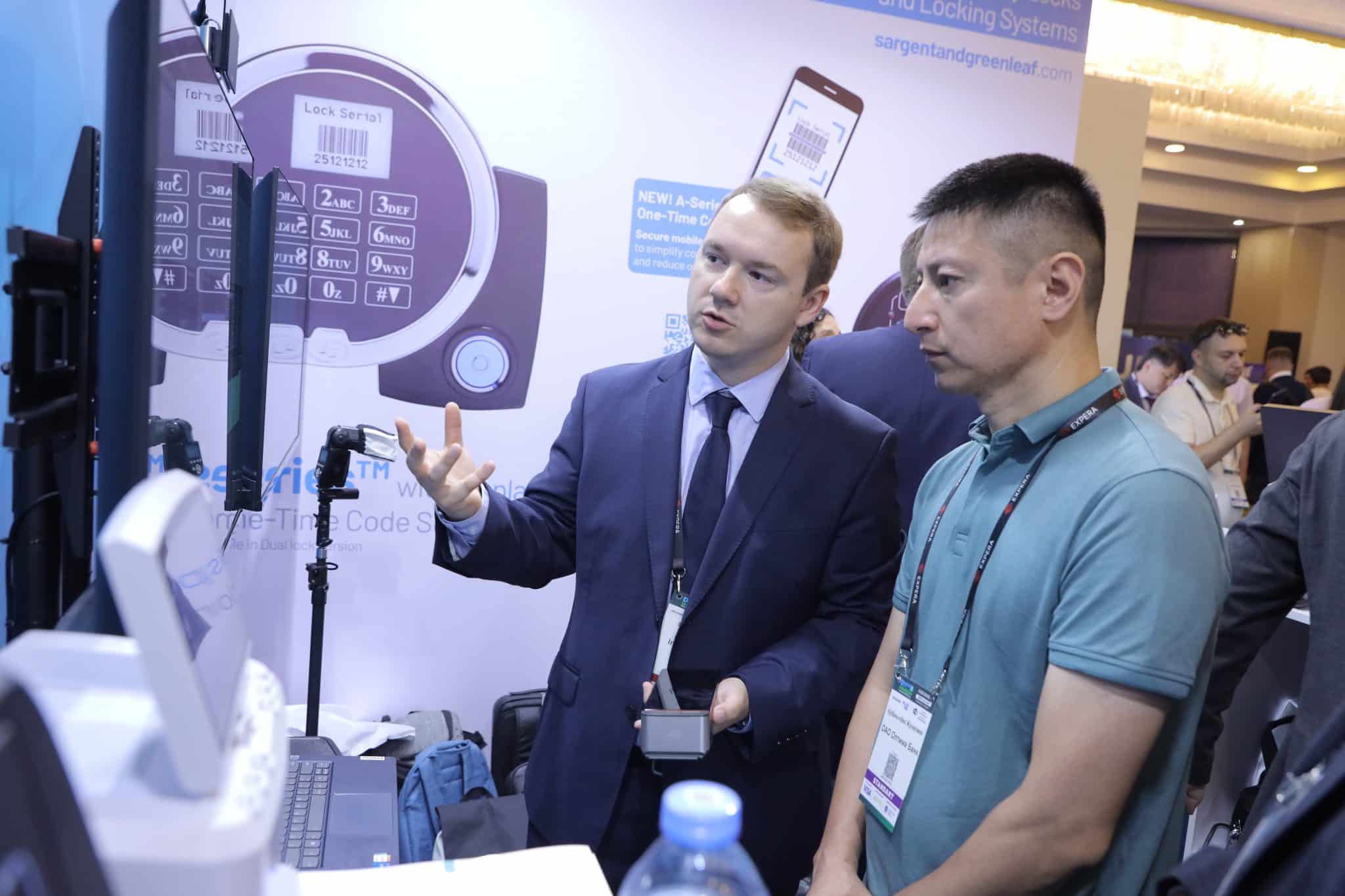

One of the goals of the company’s participation in the forum was to establish partnerships in the development of alternative payment methods. In addition, the ASHBURN International team presented its software solutions and technological products of partners at the stand. It also held meetings with representatives of acquiring banks and payment organizations.

The Uzbekistan market represents a significant potential for ASHBURN International. The average age of the country’s population is 29 years old, and the younger generation demands innovative services. Besides, fintech development is actively supported by country entrepreneurs and authorities.

According to Uzbekistan’s 2023 results, cash amounted to only 21.5% of the total money supply. Funds received on cards tend to be cashed in – over the past five years, this figure has fallen from 32% to 24%.

The population’s confidence in non-cash payments is growing, which means new prospects for digitalizing financial transactions are emerging.

Kazimieras Preikšas, Head of Department at ASHBURN International:

“In the near future, experts expect significant growth in non-cash payments in Uzbekistan. ASHBURN International’s solutions largely contribute to the development of digital technologies in the country and provide its partners with advanced payment management tools. TransLink.iQ system, as well as “3 in 1″ solution (cash desk, payment application and online financialization module) fully meet the current requirements of the Uzbek market. These software products allow us to perform a wide range of tasks and work with various payment devices. The functionality includes transaction management, integration with banking systems, payment processing, including QR codes and NFC. In addition, it provides a range of services such as loyalty programs and analytics of EFTPOS-terminals network operation. New technologies implementation does not require large financial expenses. ASHBURN International solutions can be easily adapted to the existing bank ecosystem. By reducing the cost of purchasing and operating equipment, organizations can invest in optimizing and improving existing processes.”

ASHBURN International software solutions are flexible, it is one of the key advantages for financial and trade enterprises. The company’s products support various payment methods – bank cards and contactless technologies (QR, NFC). For the Uzbek market, this is especially relevant, given the gradual transition from traditional transactions to more modern and technological payment methods.

At the forum in Tashkent, the company presented modern payment terminals SUNMI, Ingenico, SmartOne, as well as the system of management and monitoring of EFTPOS-terminal fleet TransLink.iQ and “3 in 1” solution.

The TransLink.iQ system provides comprehensive capabilities for managing a network of payment terminals, including real-time transaction monitoring. The software is easily scalable to meet growing business needs, ensuring smooth operation of the terminal network. This is regardless of the number of connected terminals or transaction volumes.

The TransLink.iQ system is already used by leading banks in Uzbekistan and other Central Asian countries, as well as in Europe and the Caucasus.

Sigitas Šniukas, Head of Sales at ASHBURN International:

“At the moment about 450 000 payment terminals are registered in Uzbekistan. This figure will grow in the near future. However, banks face not only the task of optimizing the existing terminal network, but also the need to offer additional services to retail outlets on EFTPOS-devices. The product “3 in 1” from ASHBURN International is the most demanded in the banking industry and trade of Uzbekistan. The solution combines the capabilities of a cash register and payment application, and also performs online fiscalization on payment devices.

At the Digital Uzbekistan international forum, we presented a wide range of modern SUNMI payment equipment. Among them are newly released products for the Uzbek market – SUNMI P3, SUNMI P3 Mix, and SUNMI P2 and SUNMI P2 Lite SE. These products are already known to merchants. These are reliable and convenient terminals with large screens and stylish design. The devices equipped with ASHBURN International software solutions enable a wide range of commercial operations and benefit small and medium-sized enterprises”.

Within the forum, the key employees of ASHBURN International held a series of meetings with representatives of the sphere of e-commerce and payment organizations. These organizations are engaged in the introduction of alternative methods of payment for goods and services. One of these methods is non-cash payments via QR codes. For ASHBURN International it is another direction in Uzbekistan. In other countries, the company has already successfully introduced cardless payments at EFTPOS terminals.

The function of accepting payment by QR code is included in the additional functionality, which allows to implement the TransLink.iQ system. The TransLink.iQ SmartPOS payment application is easily integrated with various business systems and allows merchants to effectively utilize alternative payment opportunities.

A significant part of the business visit was the establishment of new partnerships in the field of acquiring. To date, more than 30 banks in Uzbekistan already have terminals with ASHBURN International payment solutions installed.

Learn more about the company’s products! Use the feedback form on the site and ask questions. Our specialists will help you choose the optimal solution for your business.